How did you handle the historic sell off in the market today?

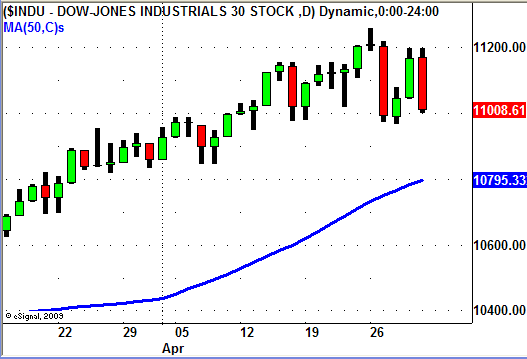

Today the Dow Jones Industrial Average dropped nearly 1,000 points before rallying back by the end of the day to finish down a mere 347.80 points.

News is coming out now about a "trading mistake" made by a "large trading firm" being the culprit for the sell off.

More importantly though is how you, as a swing trader, handled today's extreme volatility.

If you were LONG any positions did you follow your trading plan and EXIT when price hit your STOP (Initial or trailing) level?

If you were SHORT did you follow your plan and COVER when price hit your profit target?

Did you see the sell off and just "hold on" and hope for the best?

Or did you hang on for the entire down move only to see some quick profits evaporate because everything happened so fast?

And on top of that, since you held most or all of your position, you are worried about what the market will do tomorrow since this sell off may have been an "error".

If the last 3 sentences describe how you handled today's market and your current situation then I would venture to say that you probably don't have a trading plan in place.

And if you do have a "plan" then you either did not follow your rules OR your trading plan needs updating and/or more specific rules.

Now if you have a longer term outlook than the average Swing Trader (2-5 days) then this may NOT apply to you.

On the other hand if you are a short term trader than today's continuation move down gave you ample opportunity to take your profits and even trail the rest (if your strategy calls for scaling out of a position).

Let me give you an example using a trade we initiated last week.

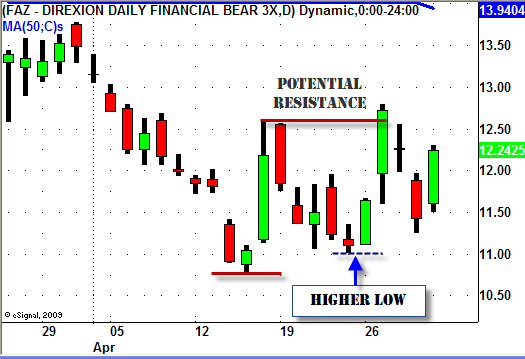

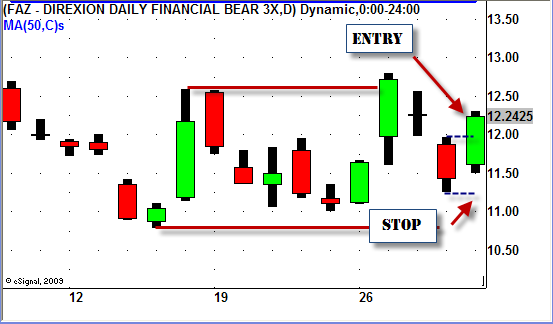

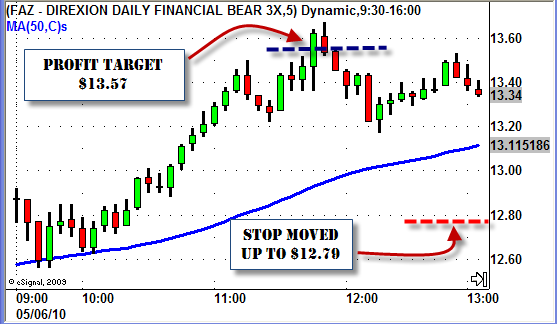

After one successful trade early in the week we alerted our newsletter subscribers last Friday of another LONG trade setup in the Inverse Financial ETF (FAZ).

We have been watching this sector closely since the negative news about Goldman Sachs (GS) came out.

After entering into the trade at $12.01 we set our initial STOP LOSS level at $11.23 which is just over 1 ATR from our entry.

Our initial PROFIT TARGET was set to $13.57, 2 ATR's, above our entry price.

As of this morning we were still in our trade so lets describe how the day played out.

Just before noon today FAZ hit our profit target at $13.57.

For this specific strategy our plan was to sell half of our position at the PROFIT TARGET and use a trailing stop, set to 1 ATR below the current price, for the remainder of our shares.

We followed our plan and exited half of our position at $13.57 and moved our STOP up to $12.79 (13.57 minus .78 which is 1 ATR).

After consolidating for over an hour FAZ started to take off at started to make new highs around 1:45pm.

As FAZ continued to rally all the way up to $15.97 we held tight and followed our plan by moving our trailing stop UP as price increased.

We trailed our stop by 1 ATR all the way up and ultimately set our final stop at $15.19 (15.97 – .78).

When the market started to bounce and FAZ turned south it happened FAST.

Here is a look at the 1 minute chart so you can see the move.

FAZ fell almost $1.50 in ONE MINUTE!

FAZ eventually came all the way back down to $13.93, more than $2 off the days high!

That is a lot of profit to give back.

Had we not quickly implemented the plan we had in place we would have given back a large portion of our profits very quickly.

If you are serious about trading (and your money) create a detailed trading plan that specifically lays out what you will do in each and every situation the market throws at you.

Having a set of rules in place (and following them) not only leads to less stressful trading but can also help you hold onto some of your hard earned profits!