Swing Trading Blog – Swing Trading Boot Camp

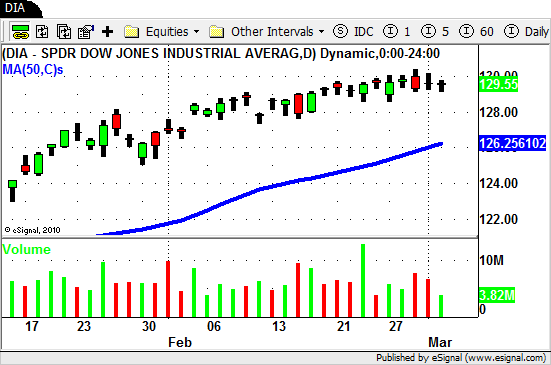

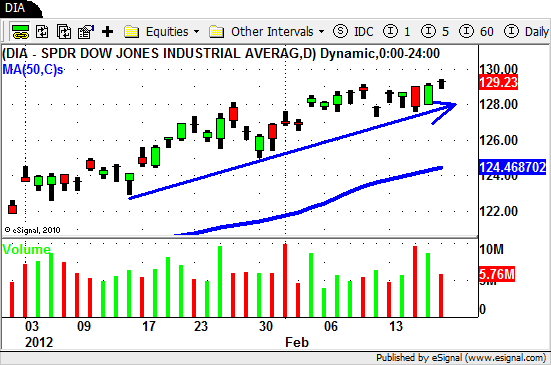

Swing Traders watched as the market puts in it's best week of the year this week.

After nothing but doom and gloom and talks of the next wave of the recession looming the market took off like a rocket this week.

But not everything is peaches and cream in stock market land just yet.

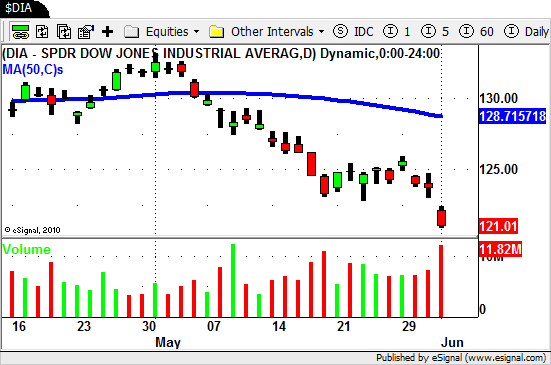

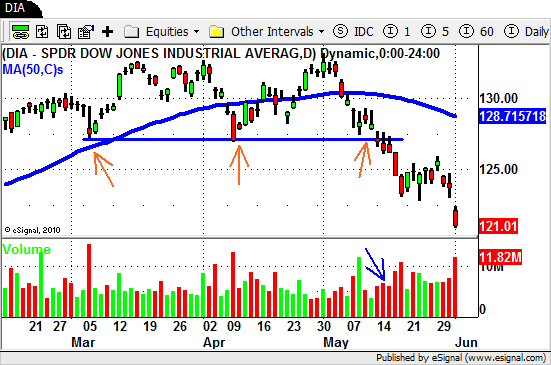

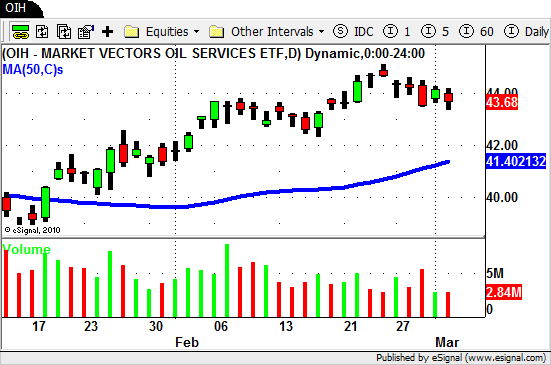

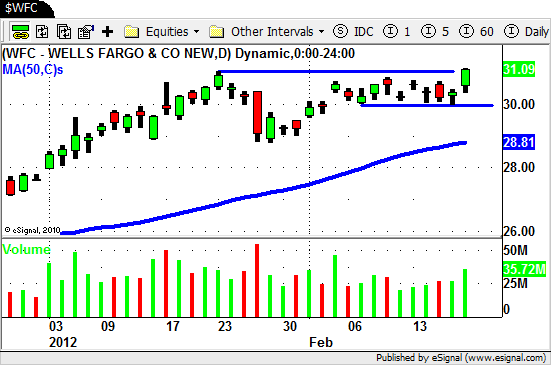

For one thing the volume on the recent UP move has been lackluster at best.

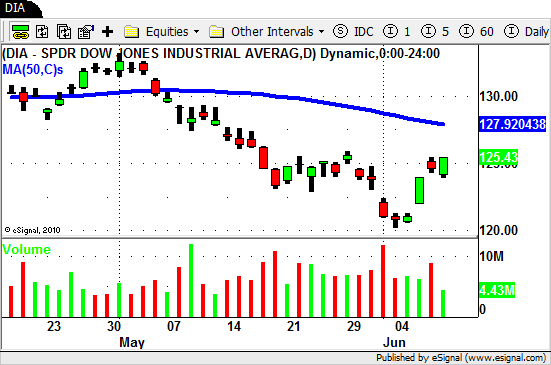

You can't really argue that it's summer time since the SELLING VOLUME we saw just 2 weeks ago spoke loud and clear.

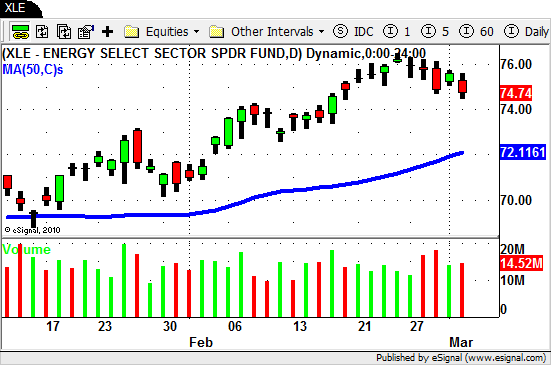

Secondly all three indicies and almost every sector ETF are still trading below their 50 day SMA's.

The markets haven't traded under their 50 day SMA's for this long since the third quarter of last year.

And finally we still have plenty of overhead resistance to break through before I would start looking for the bull to return for any length of time.

Lets be honest…it still a bearish short term market (for now).

So what is your swing trading strategy in a market like this?

Our strategy remains the same. We SHORT (or use inverse ETF's) we the market is weak and go LONG when the market is strong.

At times of transition in the market we start to see less follow and tend to get stopped out a bit more.

As SHORT TERM TRADERS these are the clues that keep us on the right side of the market.

If the market does start to turn to the upside we will notice and hopefully be able to profit from it.

Have a trading plan in place so whatever the market decides to do from here you will be ready.

Until next week…Good Trading to You!