Swing Trading BLOG – Swing Trading Boot Camp

Swing traders enjoyed the early part of this holiday shortened week but the news at the end of the week brought on a reality check.

With the dismal jobs report numbers came increased selling bringing the market down on Friday.

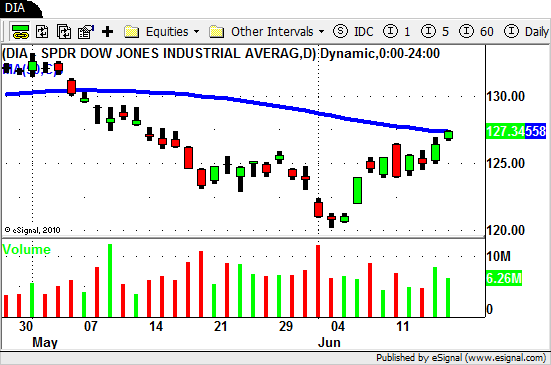

The indices basically finished flat for the week but traders had opportunity to take their profits off the table well before Friday came.

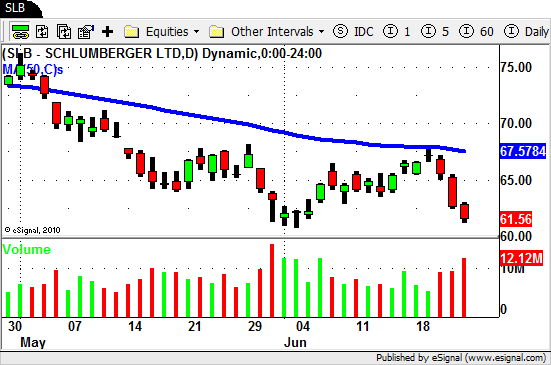

All three indicies put in a "higher low" at the end of last month are now back above their 50 day SMA's.

As the earnings season approaches we will see if they can hold above these levels and continue the uptrend.

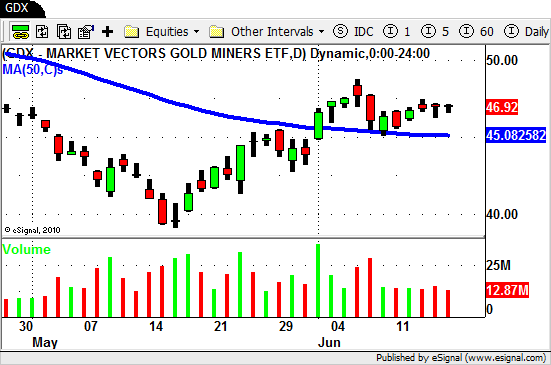

When it comes to the different sectors in the market we still have a bit of a mixed bag.

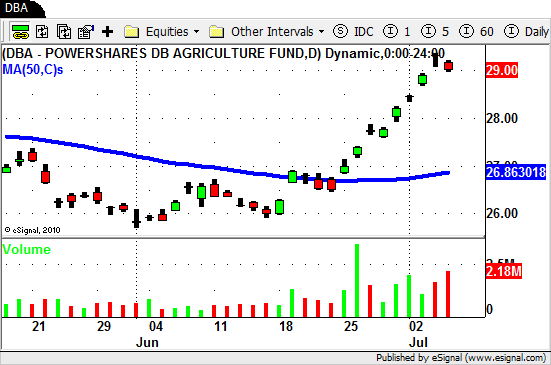

Several ETF's are showing some great relative strength.

Real Estate ($IYR), Retail ($RTH) and the Agriculture ($DBA) sectors are rocking.

The Semiconductors ($SMH) and the Broker/Dealers are still lagging a bit.

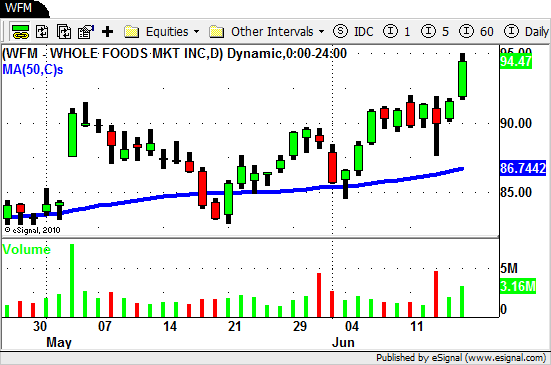

On the individual stock front we have more of the same.

We have breakouts ($ALK $WMT $O $V) and breakdowns ($ADM $AET $MRVL $LRCX).

You have to come to expect this type of price action when the market in so indecisive and trading around the 50 day SMA.

It is hard in times like these to make a strong case for just one side (long or short) of the market.

As far as individual swing trading strategies go we will look for for the market to us exactly what to do next.

If we see chart patterns forming on the long side we will need to see price action and volume confirm the next move.

If the sellers step in next week we will see a lot of these long patterns FAIL and we will look to SHORT the weaker stocks in the market.

Certainly we have some big moves in the market as we move through earnings season.

Pay close attention to what the market is telling you.

As always be prepared for whatever the market decides to do from here and act accordingly.

Until next week…Good Trading to YOU!