DOWN…UP…DOWN…wait no…UP!

Wow! What a roller coaster this week has been.

Well after last Friday's reversal day (Hammer in candlestick terms) we knew we would we in for an interesting week this week.

Would buyers step back into the market and drive it higher?

Or would the sellers regain control and push the market back down?

Well after all is said and done the market finished up a mere 87 points ( under 1%) for the WEEK.

Not very impressive!

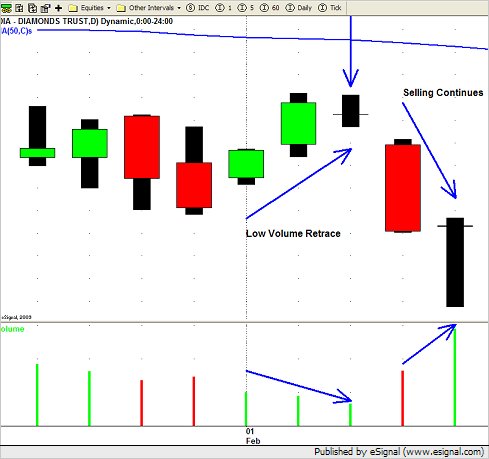

This week the market appears to have simply put in a retrace in a longer term down trend.

As you see from the chart of the Diamonds (DOW ETF) we are trading well under the 50 day SMA.

We havent traded BELOW the 50 day SMA for this many days since MARCH of last year!

A bearish sign?

We believe so, but as always, we don't want to try to PREDICT what the market will do.

As Swing Traders we simply want to ANTICIPATE what it will do and hopefully take the appropriate and profitable action in time.

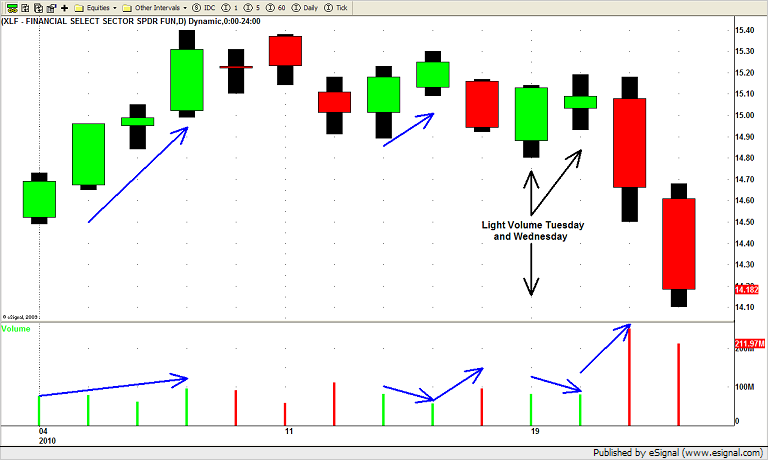

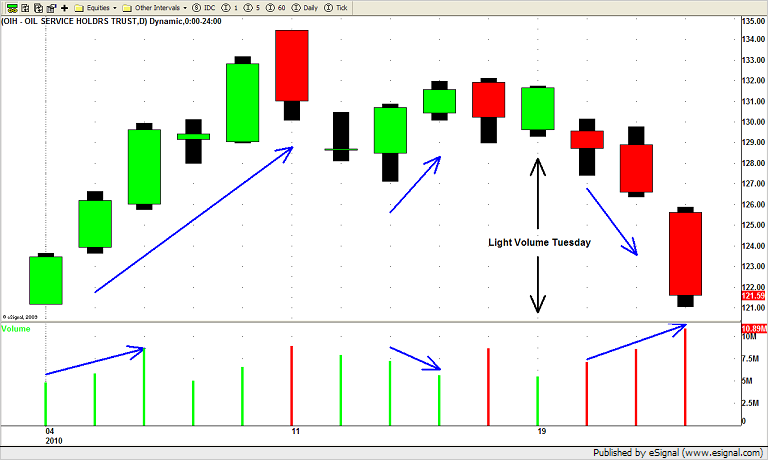

A few sectors ETF's, XLF (Financials), RTH (Retail), XLE (Energy), OIH (Oil Services), still look very weak in the short term.

Some sector ETF's however are showing some interesting chart patterns.

The Homebuilders ETF (XHB) is trading ABOVE its 50 day SMA and has held up quite well during the recent down move in the market.

Stocks like PHM, DHI, MTH, TOL and LEN had decent gains this week.

We aren't sure, of course, if this strength will continue in this sector but we have some small gains already "locked in" so we will trail our stops accordingly.

There has also been some individual names on our watch list that have performed quite well this week.

ASH, CMI, G, AAP and DLB have all done well while RIMM has been a rock star!

Its very hard to get aggressive to the LONG side when the market is acting the way it is.

So while we continue to have a SHORT bias we take a few LONG positions in strong stocks just in case the market continue to move up.

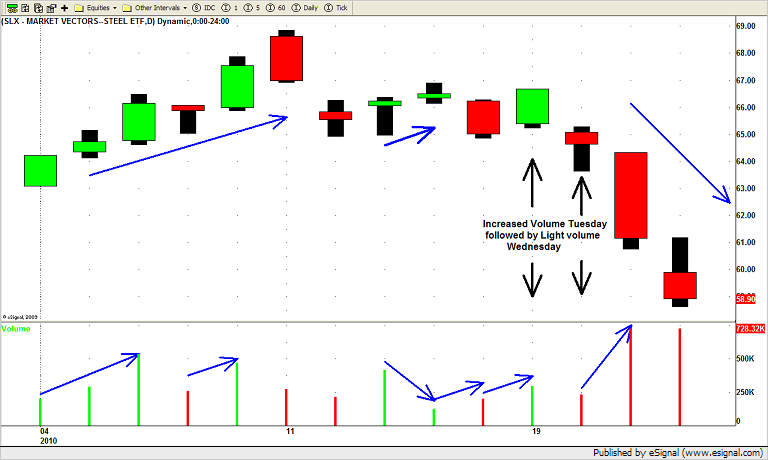

On the SHORT side there are a TON of charts showing potential SHORT swing trade set ups.

Regardless of what the market does next week we will be ready!

Until next week…Good trading to YOU!