Swing Trading BLOG – Swing Trading Boot Camp

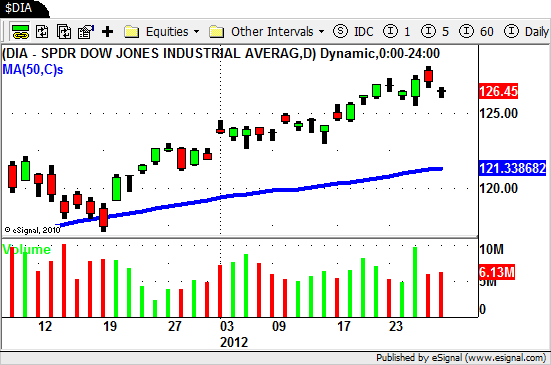

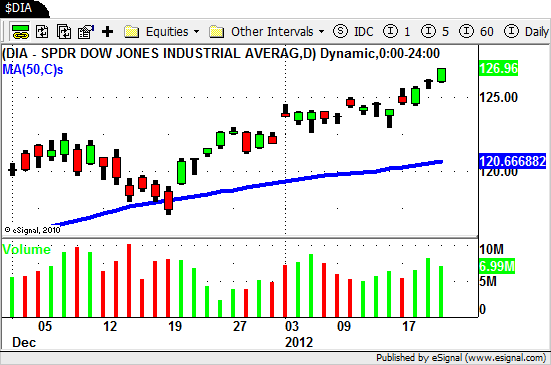

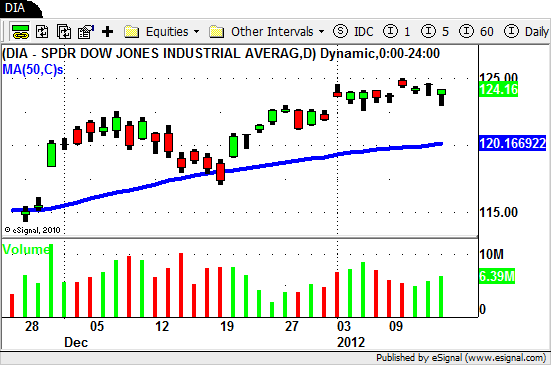

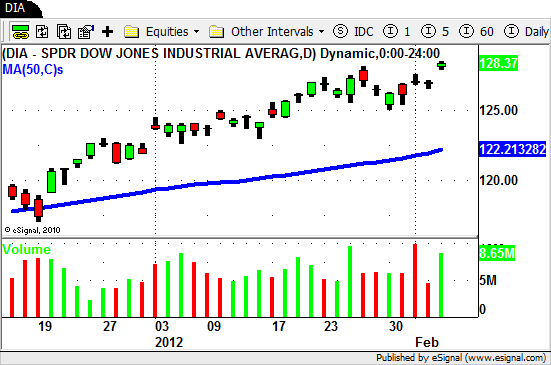

Rally to NEW HIGHS!

A great week for both Swing Traders and Day Traders as the market rallied to NEW HIGHS this week.

After a GAP DOWN and rally on Monday the indices put in a solid up move and finished the week off with a nice GAP UP Friday.

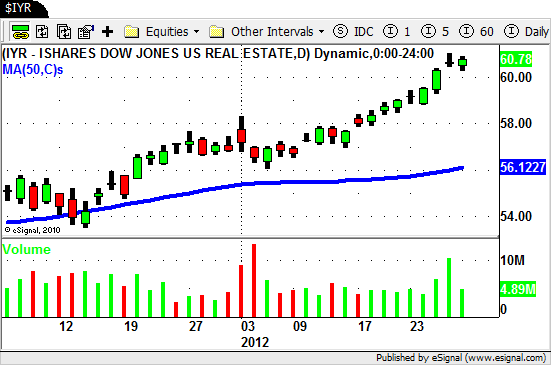

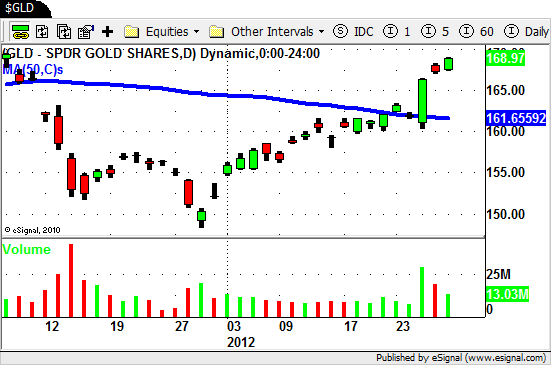

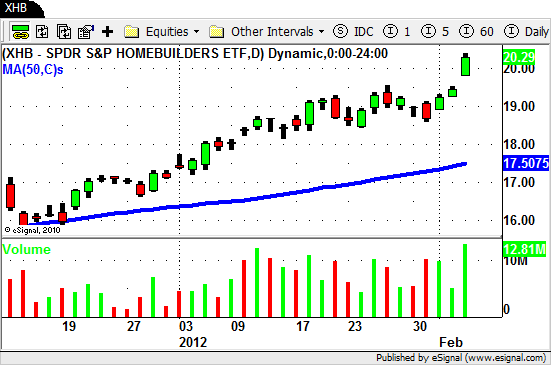

As expected the strongest sector ETF's turned in a great week.

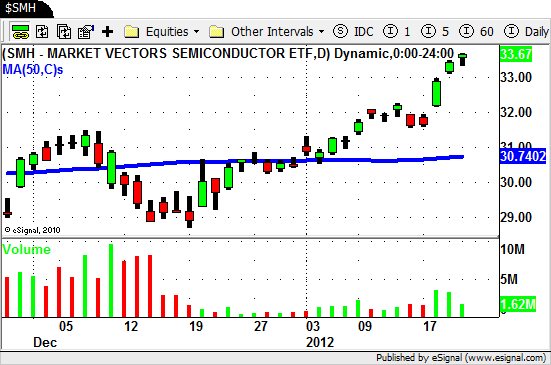

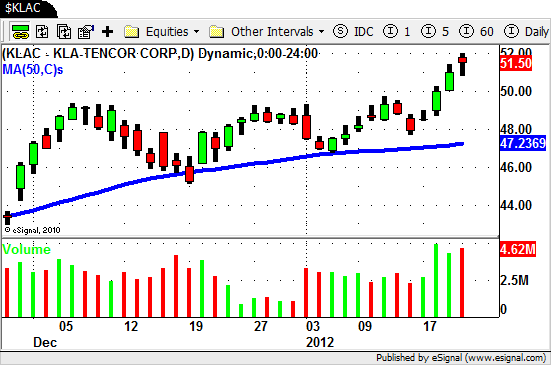

Real Estate ($IYR), Financials ($IYF), Homebuilders ($XHB), Retail ($RTH) and the Technology sectors ($SMH $XLK) all moved up nicely.

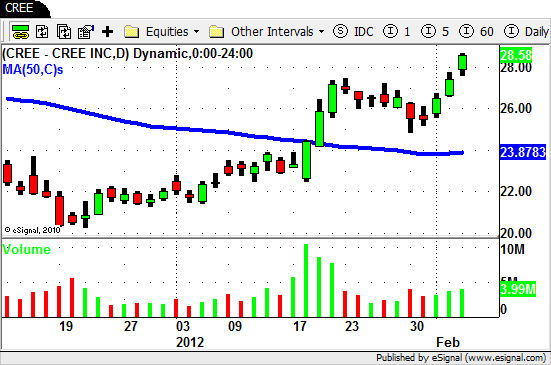

The Semiconductor stocks (which we mentioned last week) were in play this week with $CREE, $VECO, $ATMI, $MRVL, $NVLS and $LRCX making some nice moves.

$NVDA also has a good looking chart as it held its 50 day SMA and made a move higher on Thursday.

The Steel stocks we mentioned were a bit mixed with $X and $NUE moving higher while $AKS turned in a poor week.

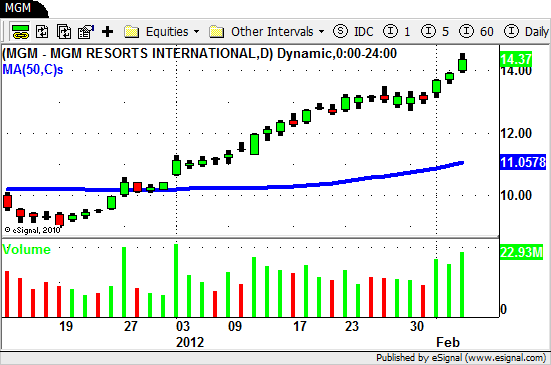

The Casino stocks $LVS $MGM continued their super strong up moves.

There were plenty (way to many to list) of great looking chart patterns to trade this week!

Actually there we so many trade set ups that there is no possible way for us to trade them all. It seemed that everything was rallying this week!

This is the kind of week that rewards you in a big way when you take action and trade exactly what the market is telling you.

This type of rally and follow through is what traders dream about and look forward to each and every day.

This brings us to our next very important observation.

The market is back in the spotlight!

The talking heads on TV will surely hype this market up and eyes will turn back on to the market in a big way.

Everyone will start looking and talking about what the stock market is doing and how great everything is.

Although it is great that the market is doing well…Don't get caught up in the hype!

As a trader you need to stay focused!

I have seen traders change nearly their entire methodology when the market goes to one extreme or the other like it has this week.

I have seen scalpers suddenly become "trend" traders. I have seen short term swing traders ignore exit signals and essentially turn themselves into position traders.

DO NOT LET THIS HAPPEN TO YOU!

Changing your strategy may work for a short time but unless you have a proven system for trading a different way then this type of change can backfire in a BIG WAY!

Stick to your trading plan just like you have been doing day in and day out.

"Let it Ride" is a term that gamblers use…not traders!

Keep your focus and as always have a plan for whatever happens next in the market.

I hope this week was good to you!

Until next week…Good Trading to YOU!