Swing Trading BLOG – Swing Trading Boot Camp

Creeping Higher!

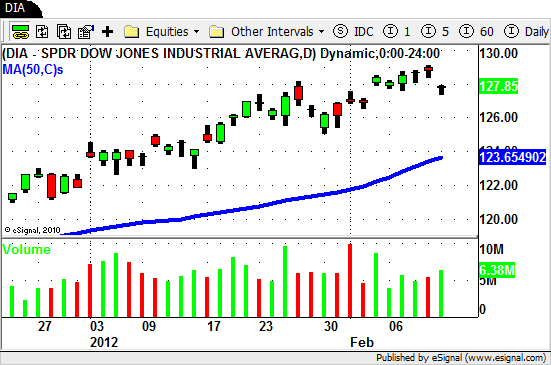

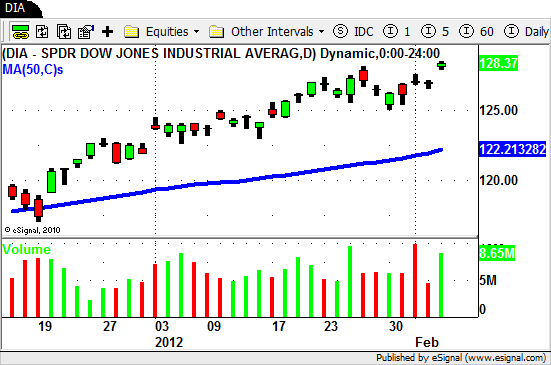

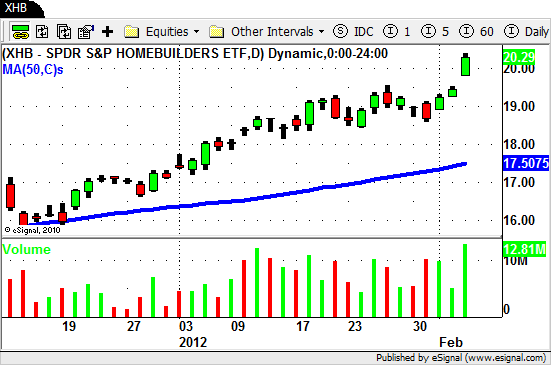

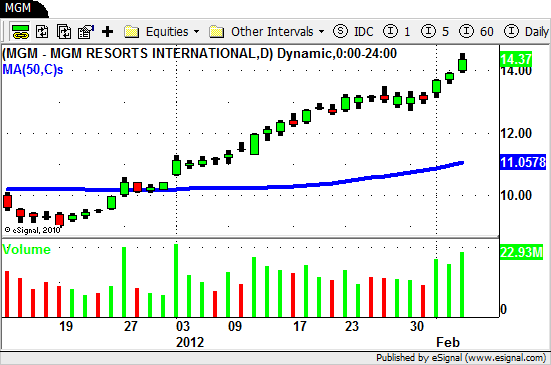

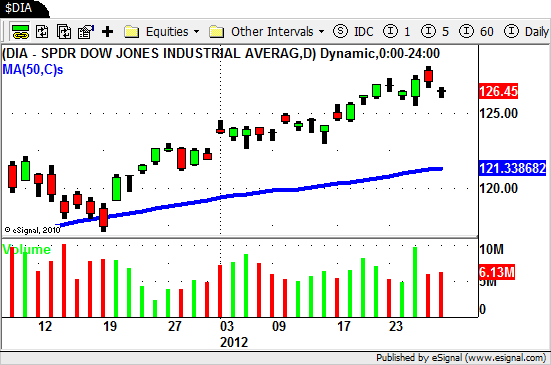

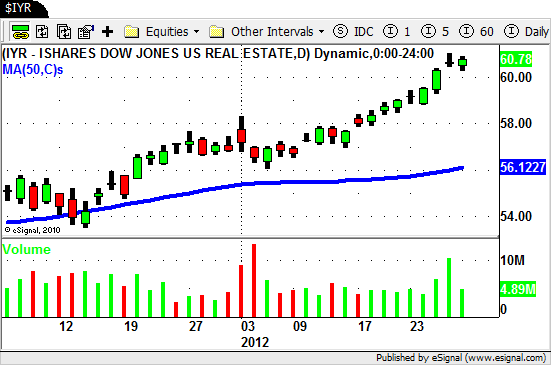

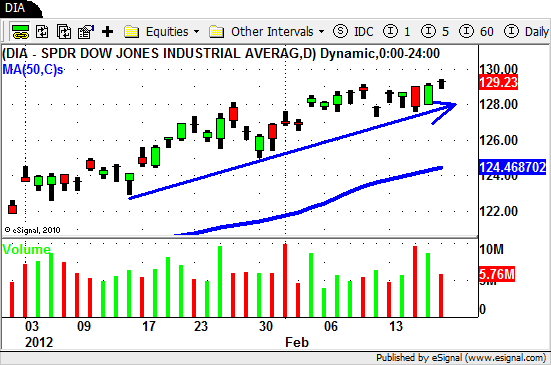

The market rallied to new highs again this week but it was a little slow in the making.

Monday traders watched as the market GAPPED UP and a decent GAP DOWN last Friday.

Tuesday we watched as the market sold off all day only to put in a rip to the close the last 30 minutes of the day.

Wednesdays price action put a lot of fear into the market and had most traders talking about a sell off.

The market spoke loud and clear on Thursday though as it ripped right out of the gate and closed near the high and above the high of Wednesdays trading.

This is why we always form our own opinions by listing to what the market is telling us. We never try to outguess the market.

Did Wednesdays price action and volume tell us anything?

Of course it did.

But we executed our trading plan accordingly and let out LONG trades play out despite all the talk of the "sell off" that was now upon us.

We did NOT change our plan and exit our positions based on what we thought "might" happen.

We were rewarded nicely for being so disciplined.

If you "hit the bid" on Wednesday you might find yourself now chasing stocks up or waiting for the next move to happen.

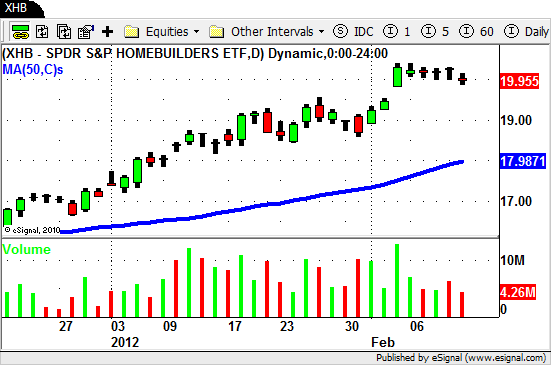

Stocks and obviously very bullish right now but there will be a retrace in the market sooner or later.

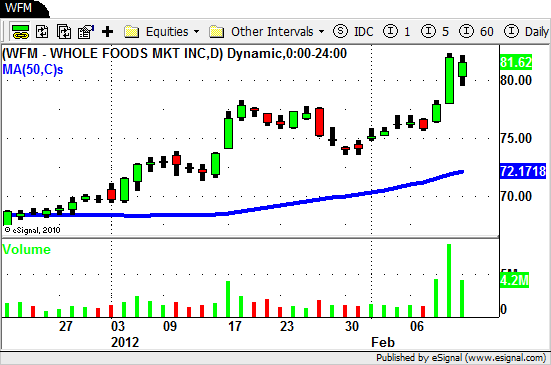

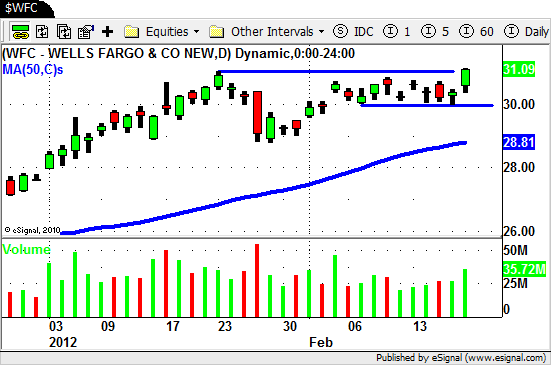

As we look forward trading on Tuesday there are plenty of stocks setting up for potential trades.

A few on our Watch List?

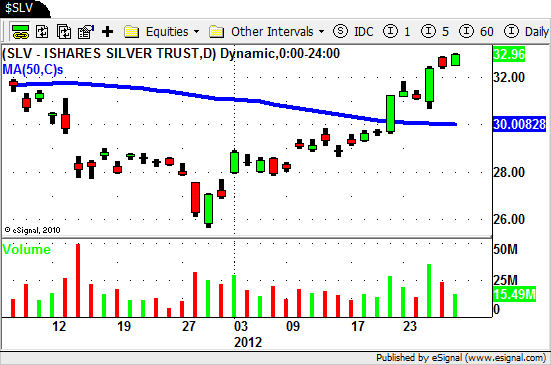

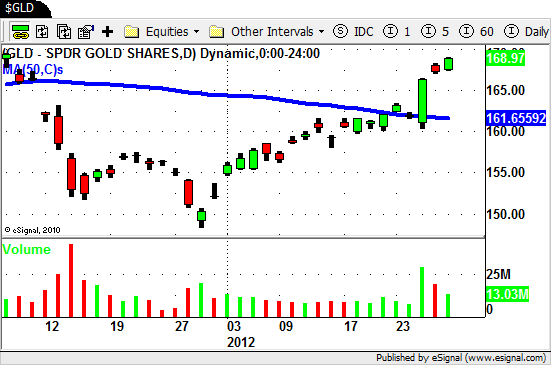

$M $CBRL $WFC $DOW $RIG $HAR to name a few.

Until next week…Good Trading to You!