Swing Trading BLOG – Swing Trading Boot Camp

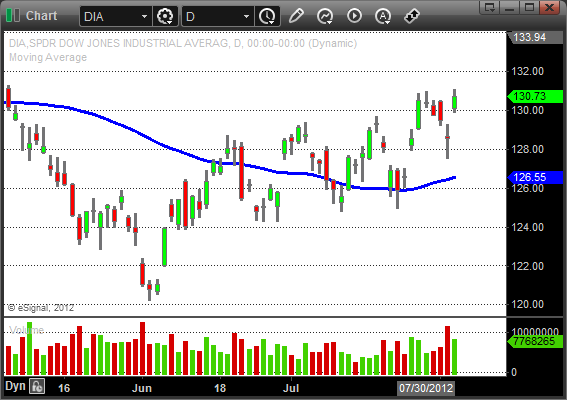

The market move lower the first four days of trading this week.

The pullback comes after bumping into some overhead resistance at the yearly highs that were put in a few months back.

Fridays price action and volume confirmed that all three indices have ended this recent retrace and are once again attempting to head higher.

Individual stocks were mixed but there were a few stand out sectors for both day and swing traders.

The Retail sector ETF ($RTH) bucked the trend and continued to move higher all week…

The Hombuilders ($XHB) traded sideways as the market pulled back this week.

The breakout on Friday is one to watch..

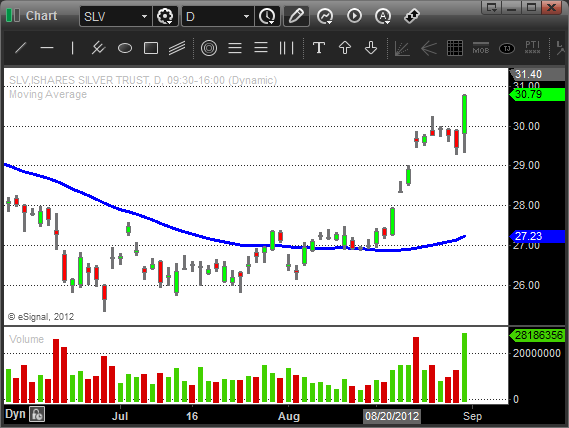

Last week we also mentioned that the Silver and Gold ETF"s ($SLV $GDX $GLD) were making some nice moves to the UPSIDE.

After pulling back to start the week both sectors exploded higher on Friday…

One sector that took a big hit this week was the Steel sector ($SLX)….

The price action here indicates that the sellers are here in a big way even though the overall market is holding up.

This is a good example of relative weakness and something to watch especially if the market transitions from bull to bear in the near future.

Keep your eyes peeled as we open for trading on Tuesday (due to the holiday on Monday) and looks for signs on continuation of Fridays move.

Get your Watch List ready and as always be prepared for whatever the market throws at you next week.

Until then…Good Trading to YOU!