Swing Trading BLOG – Swing Trading BOOT CAMP

First things first…

Happy Thanksgiving! We hope you and your family enjoyed your holiday!

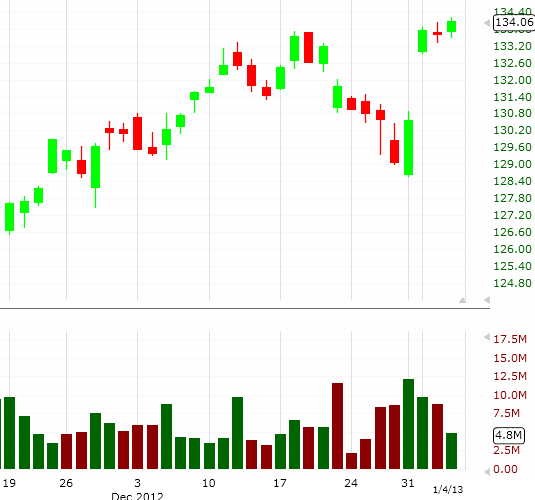

The markets opened with a bang this holiday shortened week.

Monday traders watched as the market GAPPED UP after weeks of relentless selling pressure.

The move was somewhat expected (as we mentioned in last weeks post) since the market was trading in severely OVERSOLD territory.

All three indices traded basically drifted higher on LOW VOLUME the entire week.

You can argue of course that this low volume is to be expected on a holiday week but we know that it is also a telltale sign of a retrace in down trending market.

The "bounce" was a big one nonetheless.

The Dow Jones Industrial Average rallied over 400 points in fact.

The sellers have taken a break (for now at least) and that is a good thing.

The thing to remember though is that we are still in a text book DOWN TREND.

This latest "bounce" was a retrace on LOW VOLUME.

So what happens from here after such a big bounce?

Who knows.

Some people are calling for the BEAR to lose steam and the BULL to return.

More are saying prepare for a lengthy BEAR market by getting your SHORT strategies ready to launch.

What do we say?

We say…WHO CARES???

As short term traders we need to be ready for whatever the market decides to do regardless of direction.

We are NOT investors.

If the market rallies higher? Great I have a strategy for that.

If the market starts to sell off again? Perfect because I have a strategy for that.

In last weeks BLOG post we gave you the details of our trading plan for this past week.

It played out almost exactly as we described.

Our remaining SHORT positions were stopped out so we were flat going into Tuesday,

The stocks that we mentioned that were showing signs of strength ($K, $V, $CREE, $FB) made some nice moves higher.

Did we jump onto the LONG side?

Not at all. We traded our plan and our plan was to reevaluate after the retrace was confirmed.

The gap up and drift higher scenario would have kept us out of the market anyway.

In hindsight the moves in these stocks would have produced some nice profits.

Our strategy (in this case) was not to buy stocks on a "bounce" in a strong down trend.

We followed our strategy and watched the market for the last 3 days of the week without doing anything expect getting ready for the next move.

Next week we will be watching to see if the down trend shows signs of returning.

If it does we will get SHORT all over again.

If the market shows signs of change (from BEAR to BULL) we will be prepared with a list of LONGS to jump into.

We always try to teach you you be prepared for anything and act accordingly when its time.

This upcoming week is no different!

Until then…Good Trading to YOU!