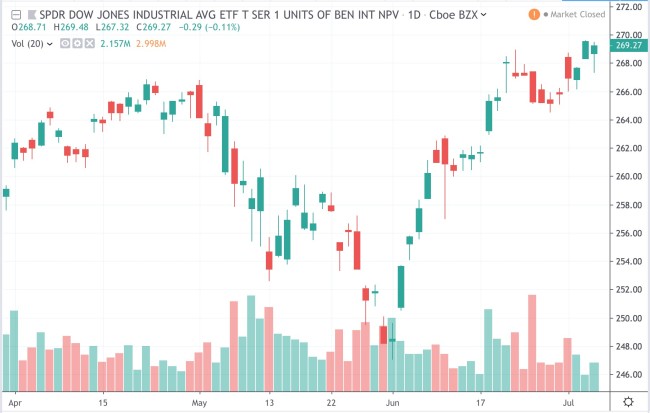

Swing Trading Blog Update 07.05.19

Even though it was a holiday shortened trading week we saw good continuation in the overall market this week.

The S&P traded to new all time highs on decent (but declining) volume.

The DJIA followed suite on a similar volume pattern.

SECTOR WATCH

With the overall market being so strong it's natural to see a bunch of strong sectors.

We have been highlighting a few on the newsletter so let's stick to those for now.

After a trading to a new high and retrace $RTH is still pushing higher.

Last week we mentioned the bank ETF's so this week we watched $KBEpull back after breaking out of consolidation. After an inside day on Wednesday it started to move higher again on Friday.

STOCKS

Again sticking with a few of the stocks that we have mentioned in previous newsletters we watched as both $MCD and $SBUX made new highs this week.

Also, previously mentioned stocks $V, $MA, $TGT, $WMT, $DIS are all holding up nicely.

SUMMARY

The continuation we were looking for arrived.

New all-time highs in the market.

It's easy to be LONG here and make a case to stay that way until the market tells us otherwise.

We have had a great move over the last few weeks and a move that brought us into new territory to end the week.

Is the market a bit extended here?

Probably.

Will it pull back, giving us a chance to look for setups for the next move up?

Who knows.

We won't be chasing stocks UP at this point that's for sure.

Are you ready for whatever happens next?

Until next week…GOOD TRADING TO YOU!