Swing Trading Blog Update – 4.29.16

Well it was definitely an interesting week to trade the markets this week!

The intraday price action was great, both on the long and short side, but it was a little different for the overnight traders.

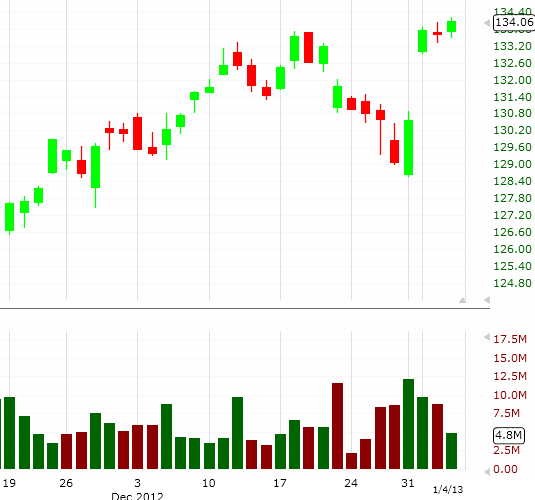

After a pullback that started at the end of last week we watched the market move bit higher on Tuesday and Wednesday.

This move up got a lot of traders LONG again…but what a difference a day makes.

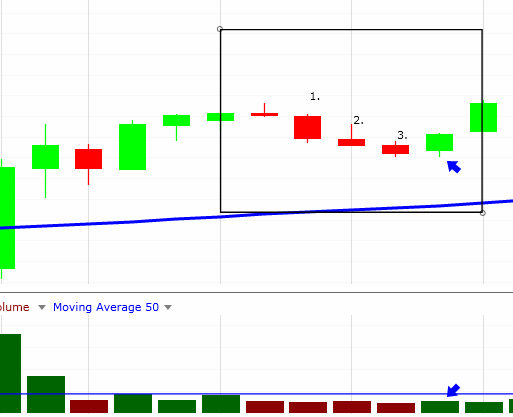

The sellers came out in force on Thursday and again on Friday.

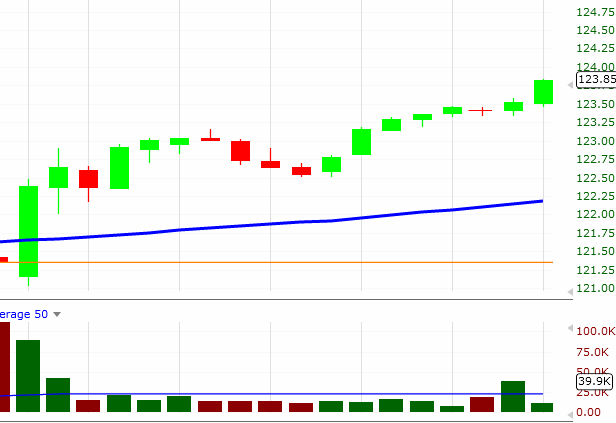

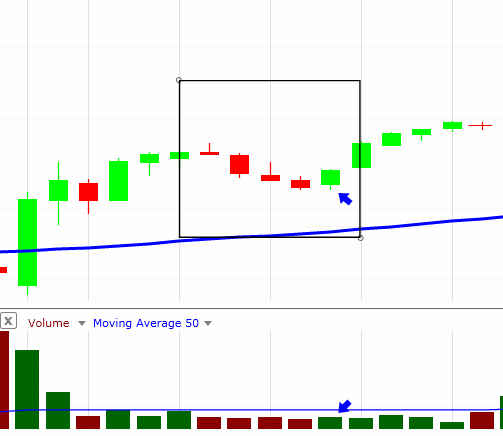

This "breakdown" created a lower high in the $DIA and $SPY and both indicies then pushed lower towards their 50 day MA's.

Take a look at the video to see a review of the stocks and ETF's we were watching and trading this week.

ETF's mentioned in the video:

$DIA $SPY $RTH $XLE $OIL $SMH $XHB $XLV $GDX $SLV $XHB $XLF $SLV

Stocks mentioned:

$G $BA $CAT $ABX $SLW $M $ANF $PCAR