Swing Trading BLOG – Swing Trading BOOT CAMP

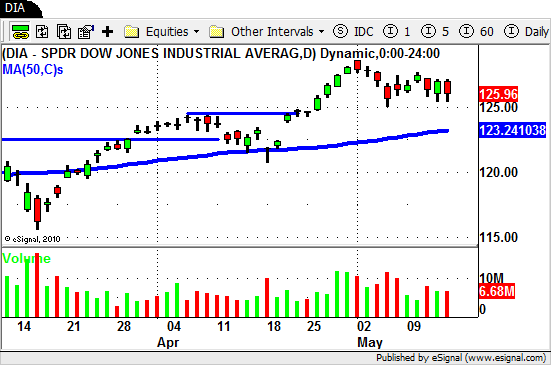

After last weeks SELL OFF the market put in a LOW VOLUME bounce to start the week.

Wednesday SELLERS stepped back into the market and pushed the market a bit lower.

The sideways trading that followed to end the week lets us know that a struggle is underway.

Oil and Energy ETF's continued their move down but the angle of the SHORT TERM DOWNTREND line is a bit steep.

The Steel sector ETF ($SLX) continued to show it's relative weakness and pushed to a NEW LOW for the year this week.

It's no surprise that stocks like $X, $AKS and $STLD offered nice SHORT trade setups this week.

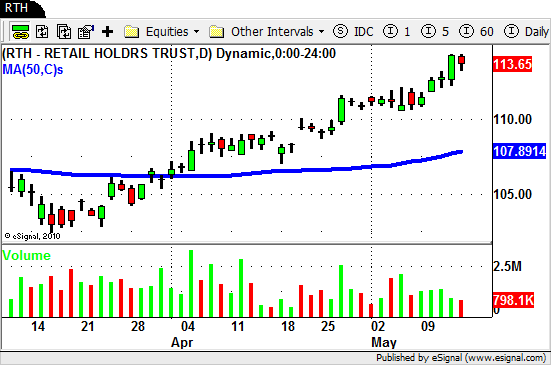

On the flip side this week was the Retail ETF ($RTH) which broker out to NEW HIGHS this week.

The move up was on INCREASING VOLUME but ended the week "stalling" at the high as volume dropped.

Next week should be interesting for sure.

The major market indices put in a LOWER HIGH so lets see if a LOWER LOW is in order.

If the previous SWING LOW holds and VOLUME comes back into the market on the BUY side then look for confirmation on a break of the previous SWING HIGH.

Until next week…Good Trading to YOU!