Intraday swing trading

As day traders we use the PVT method (price action, volume and trend lines) day in and day out.

Yesterday we saw some great examples of PVT in action.

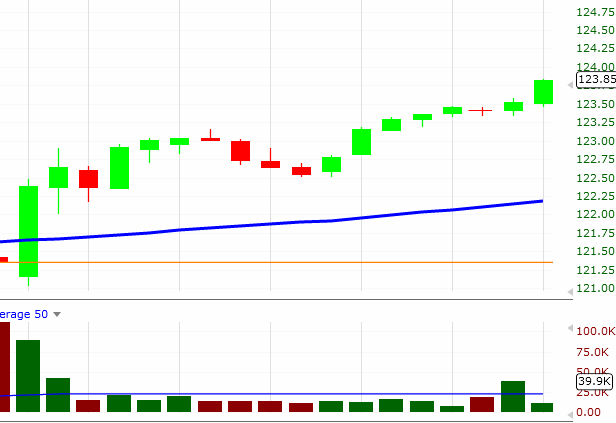

On the chart above you can see a nice up trending stock. Let's focus on the area highlighted in the box on the chart below.

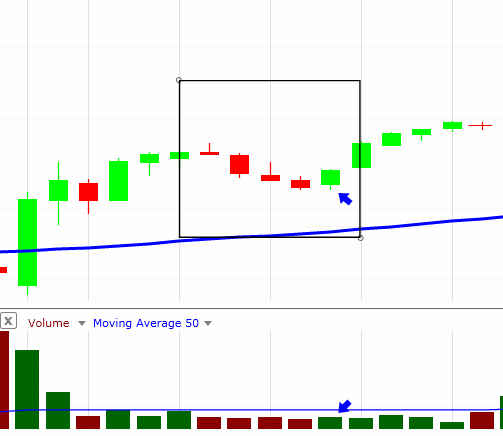

In this chart you can see one of the text book set ups of the PVT method.

The stock has already made a NEW HIGH for the day so we now that so far we are dealing with a strong stock.

The box on the chart above shows you the first retrace after the high was made.

We look for these retraces to flush out the sellers.

Once we know the retrace is in effect we look for the clues that price action and volume give us to let us know if the next move will be higher.

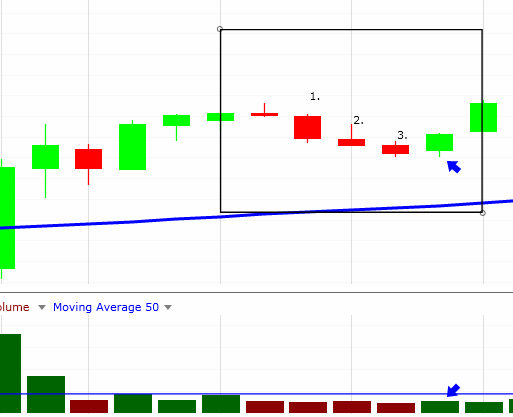

In this example the retrace begins one bar after the daily high was established. We marked this as "1." on the chart below.

This bar is followed by 2 more bars (marked 2. and 3.) which gives us our "3Down" chart pattern that we love.

After a "3Down" we watch to see if price action AND volume work together to give us an entry signal.

The next bar after our "3Down" pattern (the blue arrow on the chart) we see the tell tale signs of the next UP move.

We notice that as the bar progresses it never trades below the low of the previous bar…a bullish sign.

We also notice that volume is increasing and as this 5 minute bar comes to an end we KNOW that we have increased volume.

We also see this bar trading higher than the high of the previous bar.

As of this together is a text book entry using the PVT method.

Once the entry is made we simply manage our position and watch as price action/volume continue to tell a story.