Swing Trading BLOG – Swing Trading BOOT CAMP

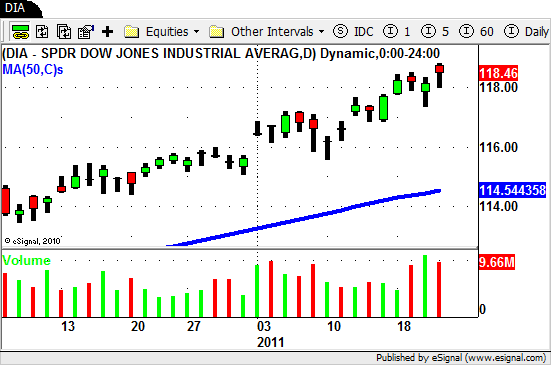

The market remains strong this week as the DJIA hits yet another NEW HIGH on Friday.

Not all is well though as the S&P 500 and NASDAQ didn't really going along for the ride just yet.

Most of the sectors on our Watch List were still in "pullback" mode as the week came to an end.

Energy, Oil, Semiconductors as well as the Financials, Broker/Dealers, and the Homebuilders are all trading just below their most recent highs.

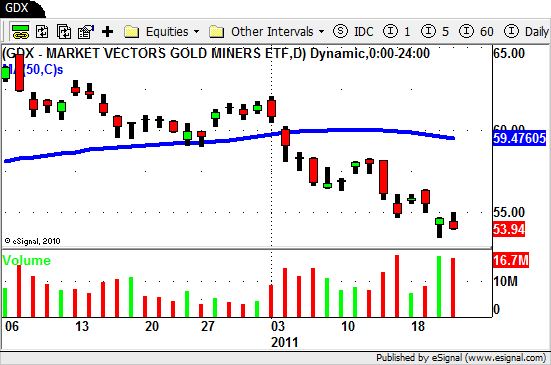

On the flip side Gold, the Gold Miners and the Silver ETF's all continued their moves down this week.

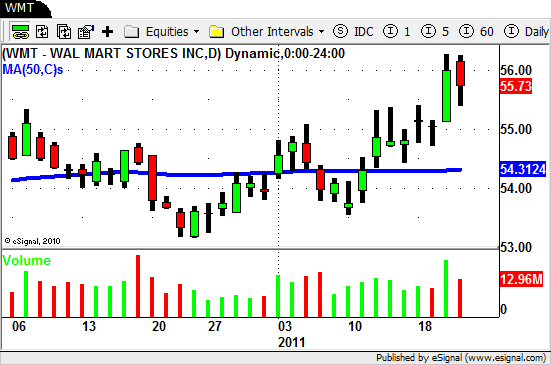

The Retail sector is still a mixed bag with some individual names like Ann Taylor Stores ($ANN), Macy's ($M), and Abercrombie & Fitch ($ANF) in solid down trends while names like Estee Lauder ($EL) and Walmart ($WMT) are holding up rather well.

Even though the market has moved to new highs yet again it seems like the market is looking for a new leader.

The market is still very bullish overall but watch the individual sector action to see which ones take the lead and which ones start to fade.

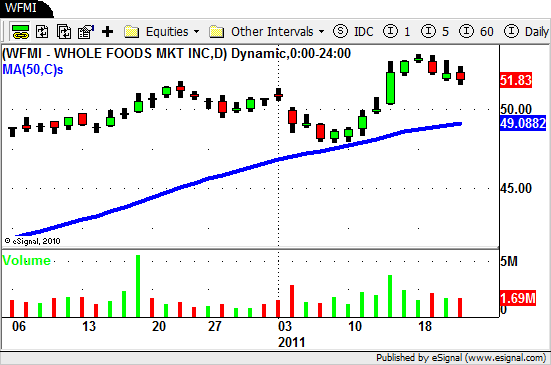

There are still a bunch of great looking charts out there that may give you some nice LONG trade set ups.

One chart we are watching going into next week is Whole Foods Market ($WFMI).

Can you tell us why we are watching this chart?

Where we would look to enter into a position?

How about a possible STOP LOSS level?

We would love to hear from you so please feel free to leave a comment or question.

Until next week…Good Trading to YOU!