Swing Trading BLOG – Swing Trading Boot Camp

Today I thought I would take some time to show you some examples of our Intraday Swing Trading strategies.

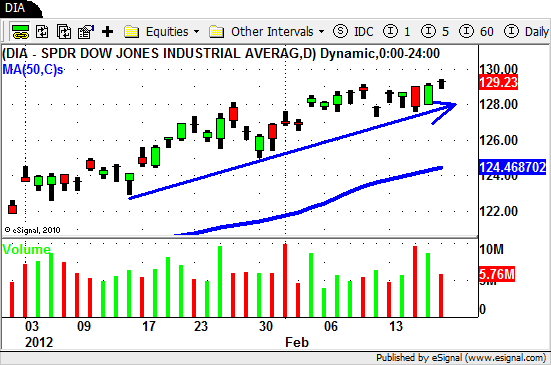

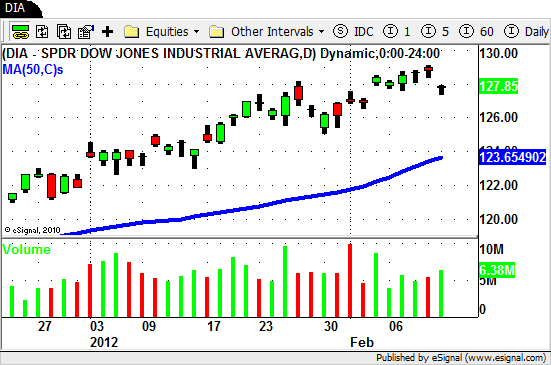

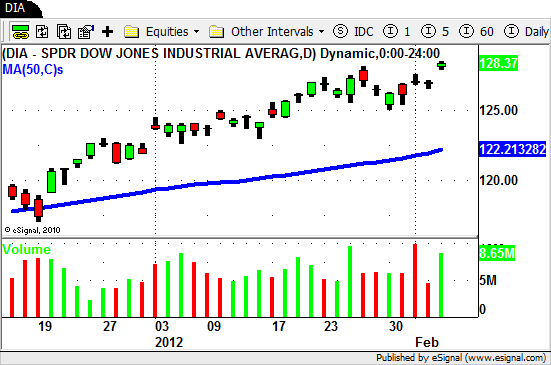

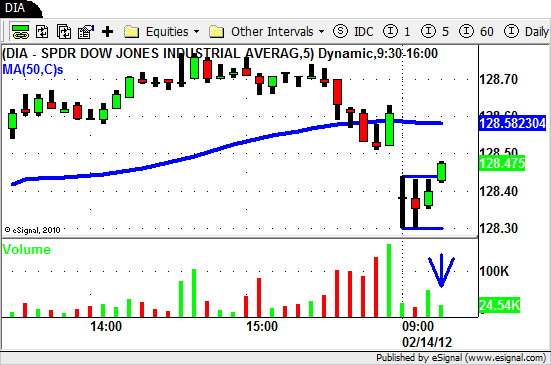

Lets first take a look at the Diamonds ($DIA) to see how the market started out this morning.

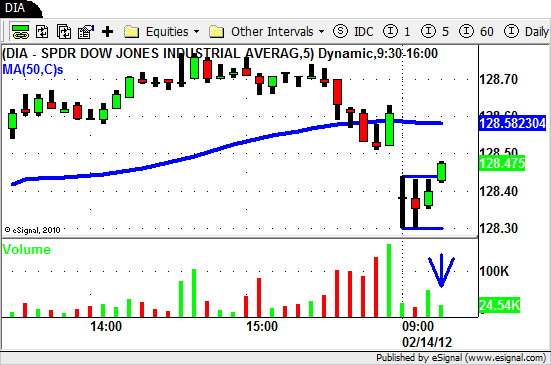

In the chart above you can see how the market GAPPED DOWN opening well below yesterdays close.

You can then see the two bars after the open are "inside bars" and this gives us a nice pattern to trade once we get a breakout.

We always wait 15 minutes (3 bars) to allow the market to establish itself before we look to enter into a trade so this was a good setup for us.

As volume starts to pick up Bar #4 creates a BREAKOUT to NEW HIGHS.

Both price action (3 bar break) and increasing volume are exactly what we need.

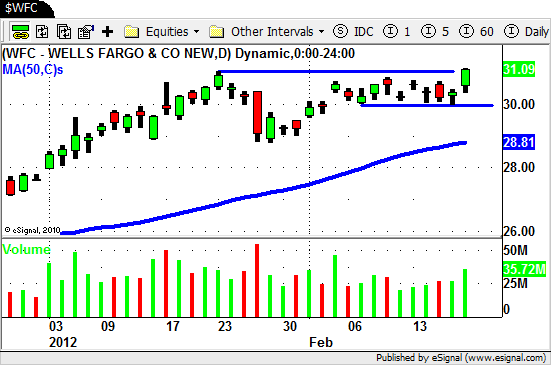

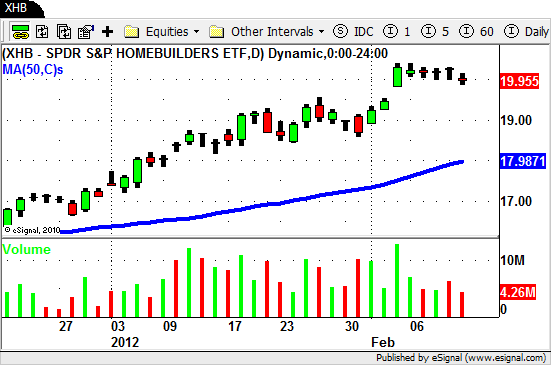

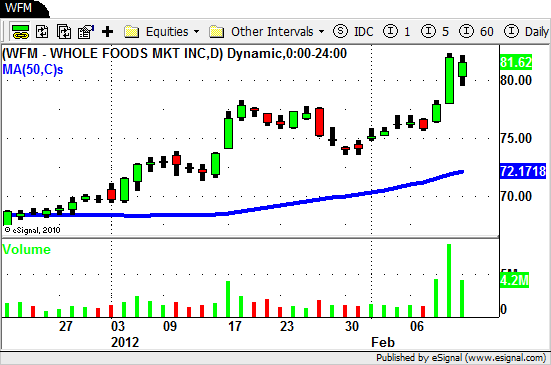

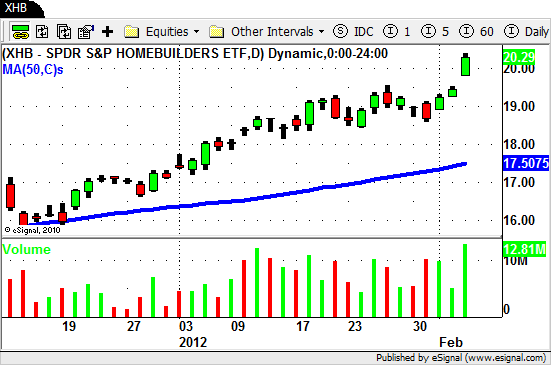

We looked around and there were plenty of stocks with a similar pattern to trade.

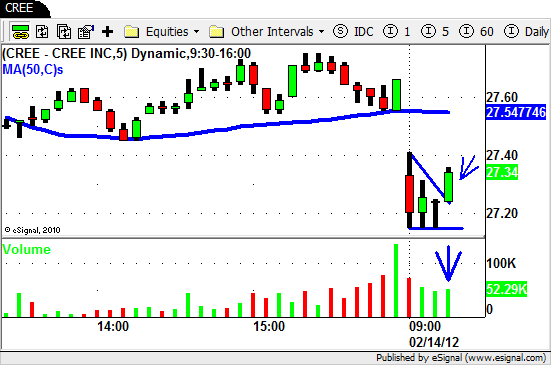

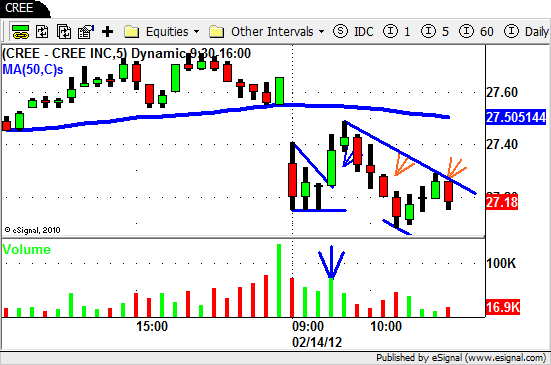

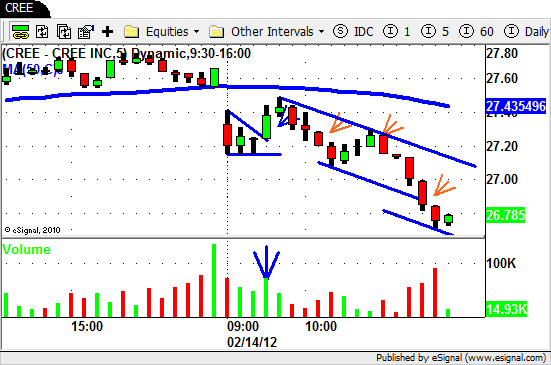

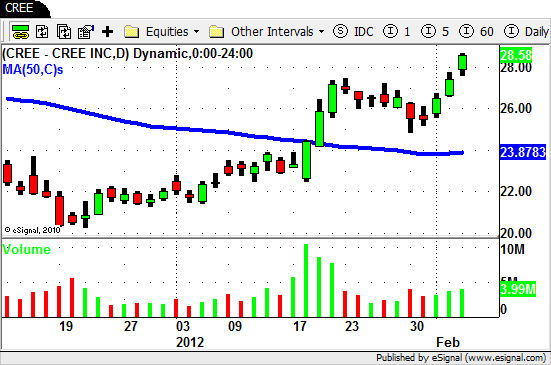

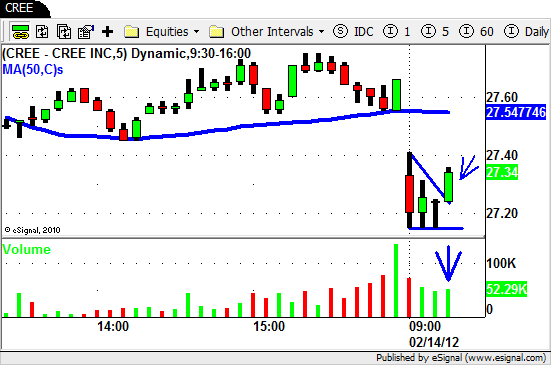

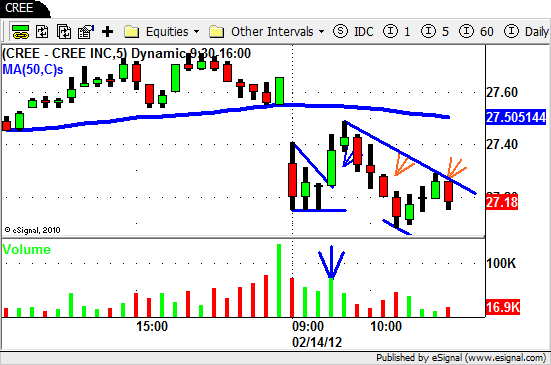

Along with $DIA $CREE stood out as a LONG trade to us with a nice pattern and defined risk.

Again the price action was good and volume was increasing.

The overall market (and $CREE) continued higher but then stalled out bit.

As an Intraday Swing Trader you have to nimble and and react quickly when the market shows signs of changing gears.

This type stalling action we see after a GAP DOWN is a flashing caution sign for us.

At this pivotal point of change you also need to scan the market to locate potential trading opportunities.

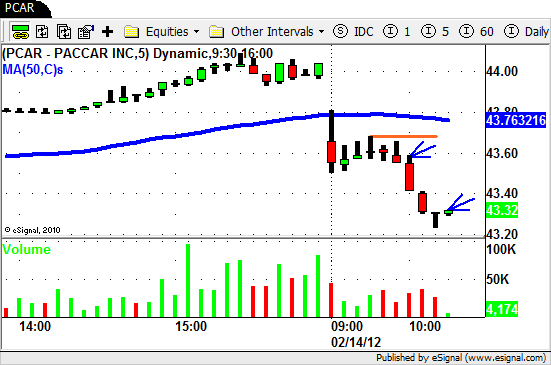

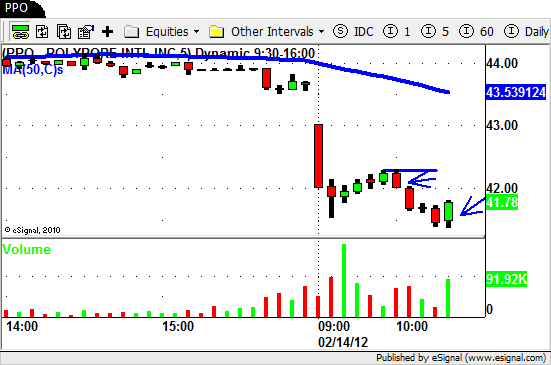

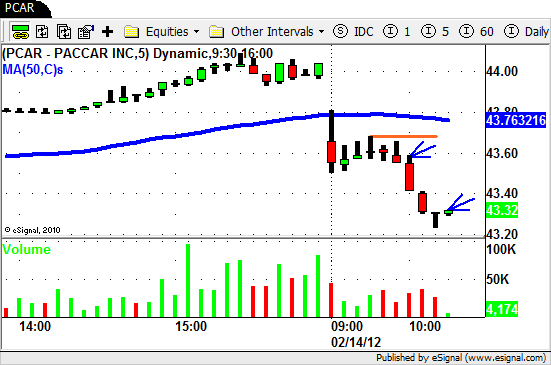

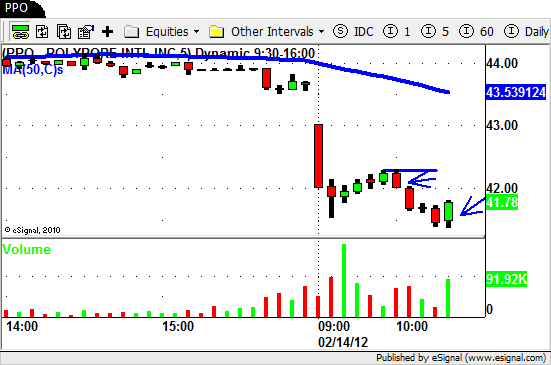

When the market "stalled" we began looking for stocks that were weaker than the overall market (relative weakness) and found $PCAR and $PPO.

Both stocks GAPPED DOWN with the overall market but never rallied to new highs when the market did.

Both stocks also created a very nice "lower higher" setups after an orderly retrace from their initial low of the day.

As the market begin to fall apart the selling volume started to accelerate in $PPO and $PCAR triggering trades in both stocks.

Our LONG trades were not looking good but we actually got out of $CREE with a profit.

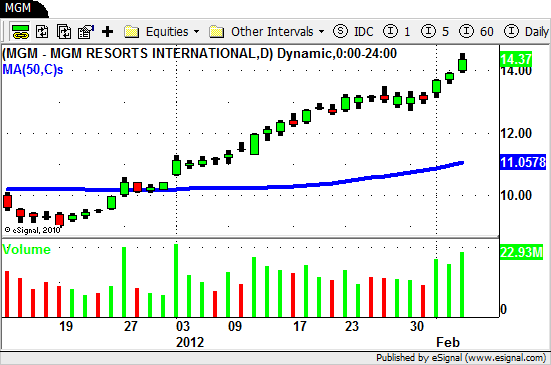

Once the market broke to down to NEW LOWS we were now in SHORT mode.

Both $PPO and $PCAR pushed lower as well before showing signs of a retrace.

A few bars later and after a retrace off of the lows the $DIA was setting up for a move lower.

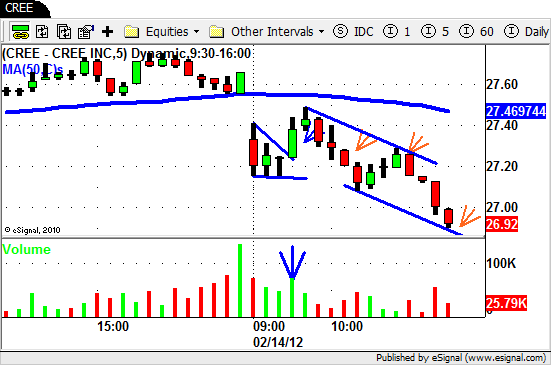

$CREE eventually sold off with the market pushing down to a new low for the day.

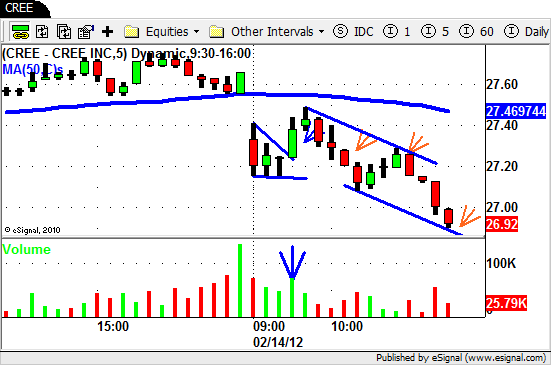

$CREE was also now setting up nicely for a good SHORT trade.

The "lower high" was established and we were now able to draw our DOWN TREND lines to create a nice channel for context.

This is classic PVT trading!

$CREE followed through nicely to the down side and created a "lower low" as the sellers stepped in.

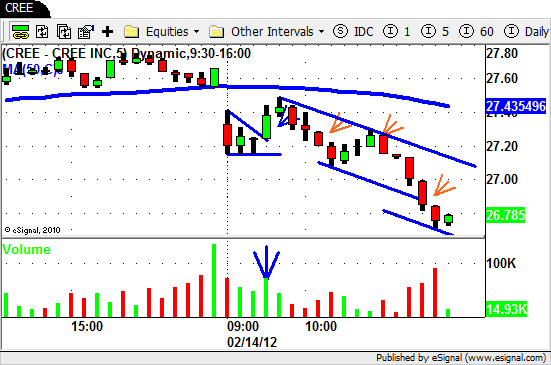

$CREE pushed through the bottom of the channel expanding it a bit before showing signs of a retrace.

The price and volume action on the last bar in the chart below shows tell tale signs of the move coming to an end.

Since we only trade the first two and last tow hours of the day we were now "flat" as the market began to retrace just after 11am.

Here is a summary for our morning.

We went from LONG to SHORT in a few stocks and identified stocks that were weaker than the market.

Once the market "stalled" and began showing signs of breaking down we took trades in these "weaker" stocks.

The market followed through to the down side and these weak stocks sold off nicely.

After making new lows the market setup for another move lower which allowed us to enter into several new trades that worked out as well.

Hopefully this walk through gives you some insight into how we swing trade intraday.