Swing Trading BLOG – Swing Trading BOOT CAMP

WOW!

What a bounce we saw in the market this week!

After putting in a short term "double bottom" pattern last week traders watched as the market RIPPED up for 5 consecutive days this week!

After talking and emailing several traders this weekend it seems that a lot of people were caught off guard.

I sat with one trader after the market close on Friday and he sat there trying to convince me that the market SHOULD not have bounced so hard.

He also told me about how his positions (mostly shorts) SHOULD have acted during a bounce.

After finally revealing that he was still SHORT (after most of his positions were now very much against him) it is apparent that he himself SHOULD have done a few things.

The most important thing to get out of this little story is have a sound set of trading rules in place and stick to them no matter what.

What you or I (or anyone else) think the market SHOULD do DOESN'T MATTER and that way of thinking has absolutely has no place in trading.

As traders we look for opportunities to profit from what we think the market MAY do.

We also know that once we enter into a trade it MAY NOT do what we had hoped for.

We as traders expect to be wrong often.

They key to success is understanding this and PROTECTING YOUR CAPITAL at all costs when you are wrong!

If you read our Swing Trading BLOG 9and we hope you do) you will tell our traders to "prepare for whatever the market decides to do and act accordingly".

That means be prepared and have a plan for action whether the market does what you expect or not.

Being stubborn and trying to out think the market is a sure way to trading disaster…trust me!

Ok so now that the lecture is over lets take a look at the charts!

Almost everything on the board RIPPED right along with the market this week.

The most important lesson to gain from looking at the charts is to learn how to spot when the SHORT TERM trend changes.

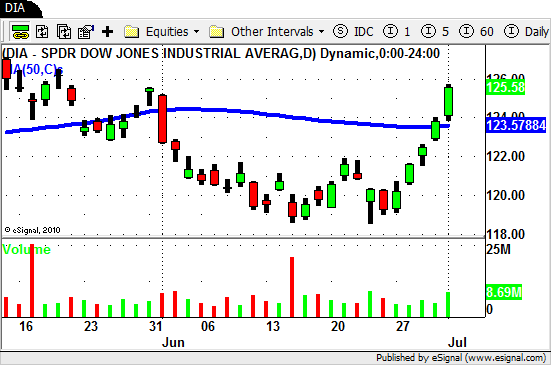

Let's take a look at the chart of the "Diamonds" above.

Last Thursday (June 23rd) we saw a big gap down in the AND reversal in the market.

The SELL OFF that day took the market down to an area that was near the low we saw on June 15th.

Once the market traded down to that level the market "reversed" and closed very near the high of the day.

Friday (June 25th) the market didn't do much as it traded sideways on low volume.

It is at this point that we as traders look for signs or clues to see what the market has in store next.

Monday we watched as the market traded higher (albeit or lower volume) which is not a good sign for the SHORTS.

If after seeing a strong reversal followed by a sideways trading day and UP day in the market doesn't give you a very loud hint that a retrace is upon you then I am not sure what will!

Tuesday the market GAPS UP (another clue) and trades in an nice orderly up trend all day (yet another clue).

Once you notice all the clues or hints you need to take action based on your observation.

For some of you that action meant to cover your SHORTS at a loss.

For others it meant to cover and GET LONG.

Our trading plan may not match you trading plan.

Our plan has us stopping out of our SHORTS and entering into some LONG positions in STRONG STOCKS.

In last weeks BLOG POST we mentioned some of the STRONG STOCKS that we were watching this week.

Take a look at the charts of the stocks we mentioned in that post and see how they did.

We have gone from VERY WEAK to VERY STRONG in the market in one week flat!

Expect some increased volatility ahead as traders try to get a handle on where we go from here.

As always be prepared for ANYTHING!!!

Until next week…Good Trading to YOU!

Tags: DIA, ETF Swing Trading, SHORT SWING TRADING, Swing Trading Blog, Swing Trading Chart Patterns, Swing Trading Price Action, Swing Trading Strategies